Company A has a small molecule that has demonstrated activity across a range of tumors in Phase 2 and is finalizing Phase 3 strategy. Ultimately the company is looking to maximize lifetime value of the asset. The company intends to model the value of each potential indication (accounting for potential price, size of opportunity and competitive intensity) and then analyze whether lifetime value is enhanced by sequencing smaller but higher priced indications first vs. focusing on the largest potential indication.

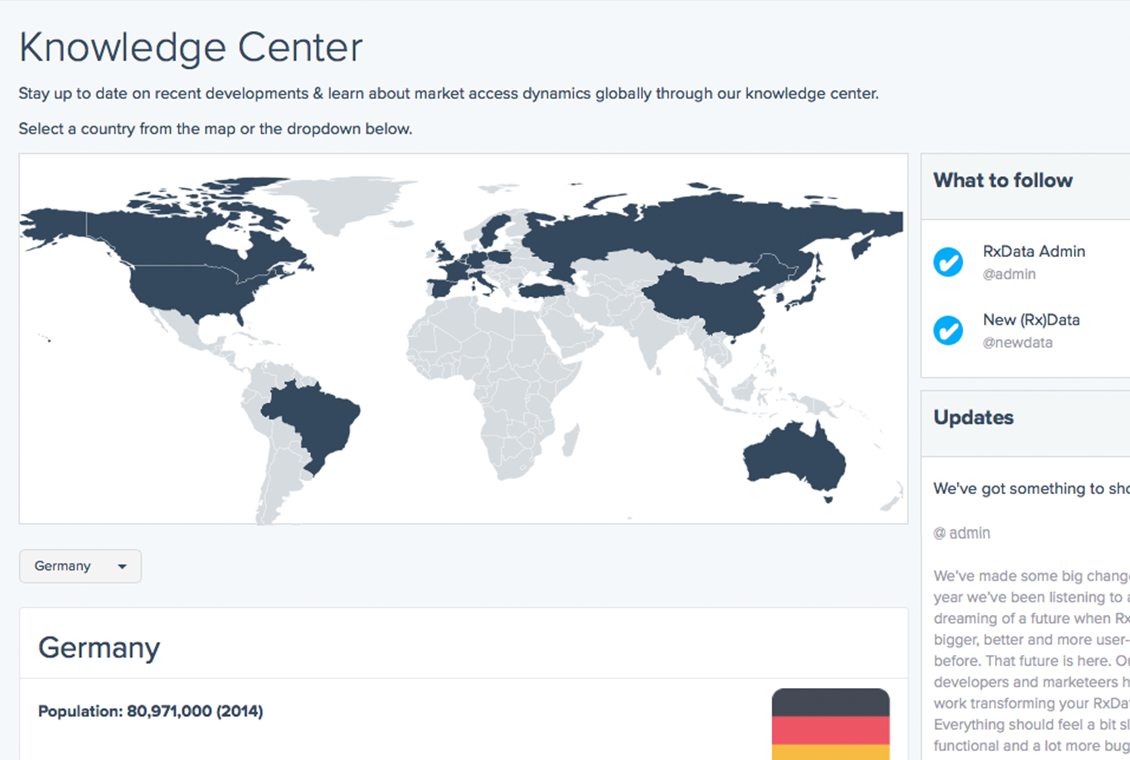

Using RxData, the company is able to quickly and reliably forecast pricing assumptions for each potential indication in each of the top 12 target markets (US, Japan, EU5, China, Brazil, Mexico, Canada and Australia). Without RxData, this would would have required a consulting engagement with a specialized firm that would cost over $1MM and take 3-4 months to complete.

Company B is working on a licensing deal for a phase 3-ready molecule in the immuno-oncology market. While the company know oncology, they are relatively new to immuno-oncology and therefore have limited internal commercialization and market access expertise. The deal team need an assessment of what data / differentiation will be required to secure market access in the major markets in the 3 year horizon. The deal process is very competitive and time is of the essence.

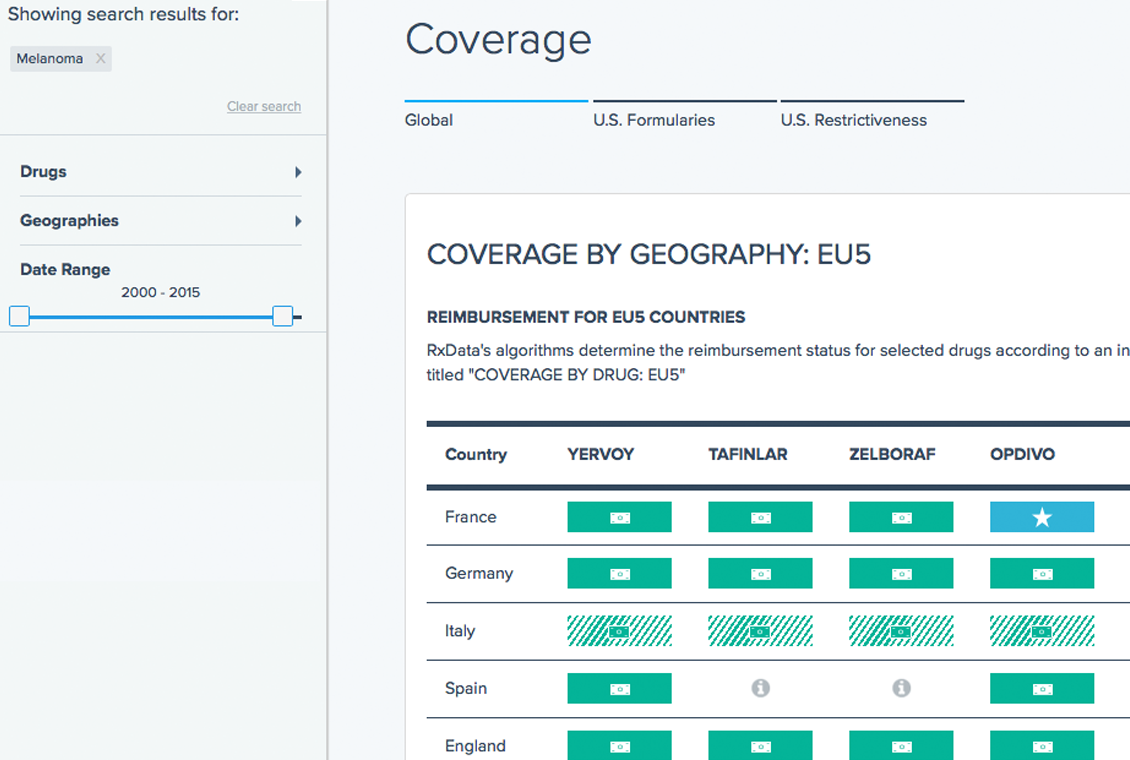

Using RxData, the deal team was able to quickly understand the level of differentiation that is presently required to achieve good access and pricing. The deal team was able to project how the competitive landscape would likely evolve and where the deal asset would fit from a competitive / market access perspective in the major global markets. Without RxData, the deal team would've been time-constrained to get any meaningful data. Traditional consulting agencies would've not been able to design, deploy and report a project on such a short timeline and would've relied on the subjective assessment of non-expert internal employees or a few interviews with external experts.

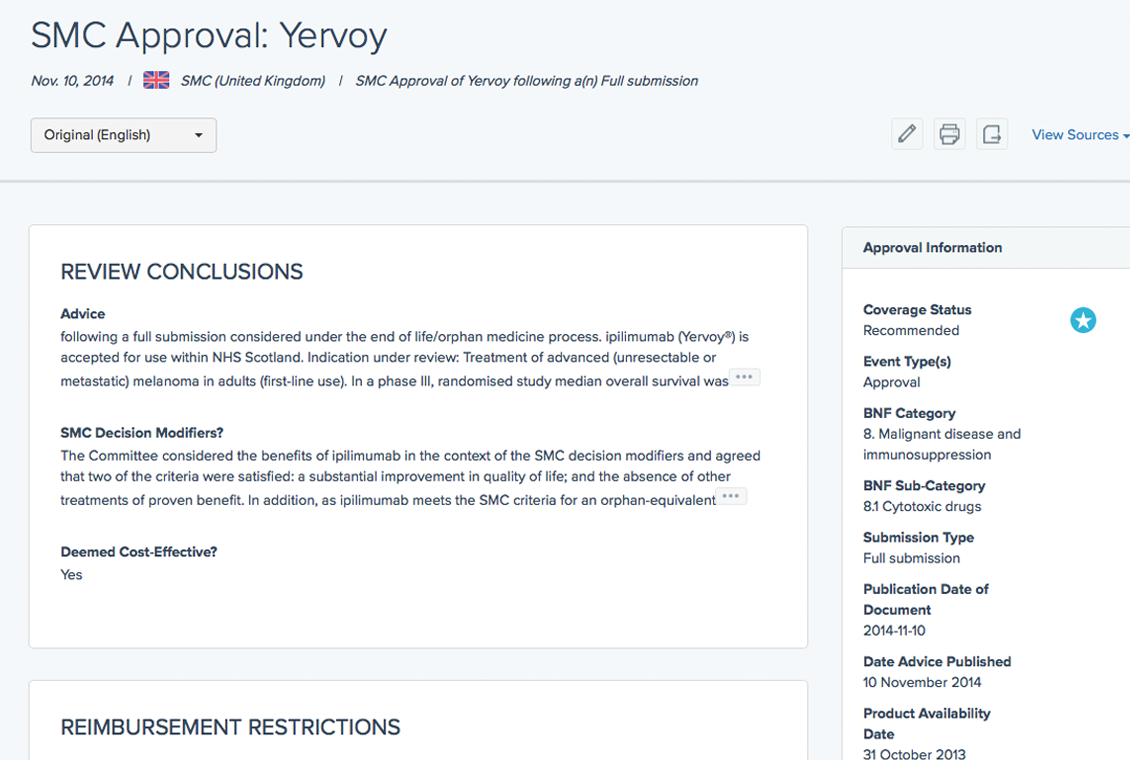

Company C has completed phase 3 development work for a NME to treat (pick a disease) and has filed with all major regulatory agencies with approvals anticipated within 9-18 months. Before finalizing the key arguments in the Value Dossier, the company wants an up-to-date survey all HTA decisions in the disease area. Using RxData, the company was able to immediately review all relevant Market Access decisions in the top 10 markets, including the data and arguments presented by competitive products. Without RxData, this work would have required a consulting engagement with a specialized firm that would cost over $0.5MM and take 1-2 months to complete.

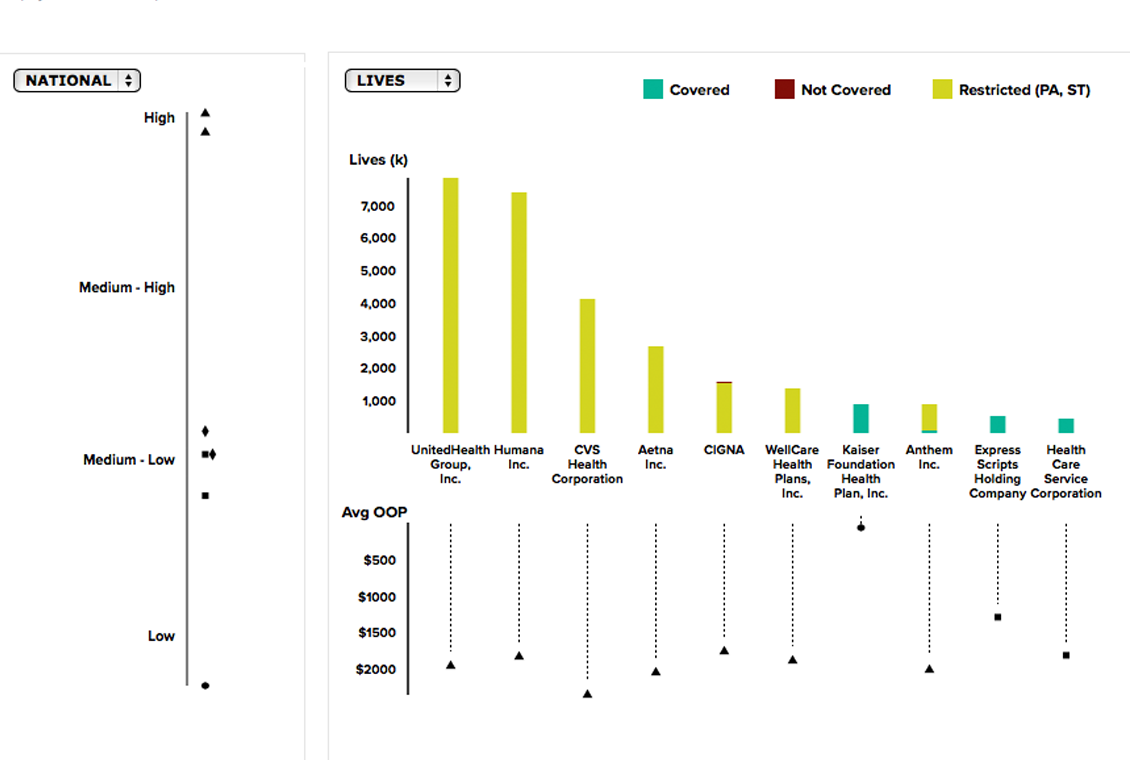

Company D is working on the first oral agent for a IV/injectable dominated therapeutic area. The current branded IV products in the market place have seen significant market erosion due to off-label use of much cheaper biosimilar, indicated for a different therapeutic area. Company D must determine the ideal pricing model for its oral compound, given the market dynamics in that therapeutic market space.

Using RxData, Company D was able to assess analogues in the US and EU of an oral agent entering an IV market area with existing market share and price erosion to determine the optimal pricing strategy for its unique mode of delivery. The research, based on access to RxData's critical resources, was presented to Company D's International Development Committee for rapid assessment of that compound’s R&D viability.Without RxData, the team would've had to deploy global pricing market research and subsequent reimbursement analysis, which would have taken months compared to a few days using RxData.