Company News | Oct. 5, 2016

In reponse to the IMS Institute for Healthcare Informatics September 2016 report titled “Comparison of Hepatitis C Treatment Costs” and FiercePharma’s follow-up article “Surprise: Gilead's hep C wonder Harvoni costs less in U.S. than in EU, Japan”

Links to both articles:

IMS Institute for Healthcare Informatics

FiercePharma

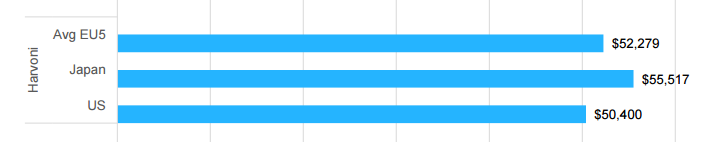

While IMS justly concludes that net prices are “very similar” between the U.S. and other developed markets, we find FiercePharma’s conclusion that Harvoni costs less in the U.S. than in EU & Japan hasty.

IMS bases their report on relatively transparent assumptions:

• List prices were compiled from public sources. Net (negotiated) prices were compiled from the public disclosures of market participants (manufacturers, payers or governments) and obtained from published media reports.

• Average discounts are 15-20% off list prices, except in the U.S. where discounts of 45-55% have been disclosed for Sovaldi and Harvoni

IMS does cite some potential bias:

• However specific media reports also reported in U.S. dollars and exchange rates were not disclosed.

• Most countries have negotiated specific price levels while others have negotiated prices contingent on levels of utilization.

What IMS finds: